1. Sponsors:

The sponsors for this US Reit a JV between KBS Pacific Advisors and Keppel Capital.

Keppel Capital is the asset management arm of Keppel Group and currently manages 3 Singapore-listed Reit/Business Trust.

- Keppel REIT - Office/Commercial Asset

- Keppel Infrastructure Trust - Utilities Infrastructure

- Keppel DC REIT - Data Centers

KBS Pacific Advisors is one of the largest US commercial real estate manager with about US 11.3 billion assets under their management. KBS is jointly owned by 4 partners - Peter McMilan III, Keith D.Hall, Rahul Rana and Richard Bren with Peter McMilan III serving as the chairman. Along with Keith, they hold one-third of the stake in KBS.

2. What type of real estate do they hold?

Keppel-KBS US Reit will hold a total of 11 freehold offices properties in the United States with an aggregate of 3,225,739 sqft spanning across the West Coast, Central Region and East Coast. Yes, free hold. I love the properties that are freehold. This is also a pure US-play Reit.

|

| Page 164 of KKREIT Prospectus |

West Coast:

- The Plaza Buildings - situated at the CBD of Bellevue (Seattle). Consist of 2 Class A office buildings with a NLA of 490,994 sqft.

- Bellevue Technology Center - situated at the sub market of Seattle-Bellevue region office market with a NLA of 330,508 sqft.

- Iron Point - situated at Folsom, Sacramento, Consist of 5 Class A office buildings with a NLA of 211,887 sqft.

- Westmoor Center - situated in Northwest Denver, it's situated near the downtown of Denver and Boulder. Consists of six Class A office buildings with a NLA of 607,755 sq ft of NLA.

- Great Hills Plaza - situated in Northwest Austin, Texas. Consist of a three-storey Class B office building that contains 139,252 sq ft of NLA.

- Westech 360 - situated in Northwest Austin, Texas. Consist of 4 three-storey Class B buildings with a NLA of 173,058 sq ft.

- 1800 West Loop South - situated in Houston’s Galleria West Loop submarket, and consist of a 21-storey, Class A office tower with a NLA of 398,490 sq ft.

- West Loop I & II - situated in Bellaire, suburb of Houston, Texas. Consists of 2 Class A office buildings with 313,873 sq ft of NLA and a high concentration of its tenant base from the healthcare and professional services sectors.

- Powers Ferry Landing East - situated in the Cumberland/I-75 submarket of the Atlanta Office Market. Consist of a six-storey, Class B office building with a NLA of 146,352 sq ft.

- Northridge Center I & II - situated in Atlanta, Georgia, in the Central Perimeter, one of the largest office submarkets in Atlanta. Consists of two Class B office building with a NLA of 186,580 sq ft.

- Maitland Promenade II - situated in Orlando, Florida. Consists of a five-storey Class A office with a NLA of 226,990 sq ft.

Tenant Mix:

From below, we can see that there is no heavy concentration of tenants. In another words, the departure of the biggest tenant will only contribute to a loss of 3% of their cash rental income.It also seemed that among the biggest tenants, the sector that contributed most belong to the Finance and Insurance sector. This may not exactly be a good thing. During a financial crisis, where finance company will be taking a big blow, KKREIT might be impacted adversely when the finance companies are not able to pay for the rental.

|

| Page 170 of KKREIT Prospectus |

3. WALE:

The IPO portfolio has a WALE of 3.9 years with most of their leases expiring from 2022 and beyond.

|

| Page 171 of KKREIT Prospectus |

Current occupancy rate is standing at 88.1% and the table below shows the occupancy rates across the 11 properties.

|

| Page 133 of KKREIT Prospectus |

4. Net Asset Value (NAV)

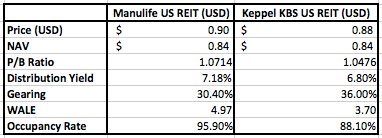

NAV of KK-US Reit properties stand at US$ 0.84 with their portfolio size at US$ 804 million. At the IPO price of US$ 0.88, it translates to a premium of 4.7% with a P/B ratio of 1.047. However, comparing to the nearest peer (Manulife US REIT), they're also trading at a premium of 7.7% at the price of 0.90 today. Hence, this IPO is not exactly a cheap IPO and at 1.047%, they're fairly priced.

5. Gearing:

Currently, the gearing is currently standing at 36%, which is not exactly low and is 9% away from the MAS ceiling of 45%. This also means that there is a slight headroom for KKREIT to take up debt for future acquisition. However, as REIT is to pay out 90% of their earnings as distribution, at 36% gearing, this will mean that not much debt can be taken for acquisition in the future.

|

| Page 34 of KKREIT Prospectus |

6. Dividend yield

The DPU forecast for FY2018 is estimated to be at 6.8% and 7.2% for FY2019 with a 5.8% growth in DPU from rental escalation and organic growth.KK REIT's distribution is slightly higher than the average DPU for SG Office REIT.

The higher yield serves as a compensation for being exposed to more risks such as forex movements and the US economy.

|

| Page 32 of KKREIT Prospectus |

7. Principal Unit holders:

As seen from the table below, the issuance is pretty well supported from cornerstone investors such as Affin Hwang, Credit Suisse, DBS and Hillsboro amounting to almost 40% of the total units issued! Sponsor interest is also nice at 14-19% from Keppel Capital (KCIH) and KBS depending on over-allotment exercise.

|

| Page 111 of KK REIT Prospectus |

The following table shows the timetable and important dates for the listing.

|

| Page 74 of KK REIT Prospectus |

The closest match for this is no doubt Manulife US Reit. Both Manulife US Reit and KKREIT are pure US asset play and consist of offices. So based on some metrics mentioned previously, let's have a closer look (as of 31/10/17).

Latest financial report from Manulife USD Reit (ended on 30/06/17):

|

| Manulife USD 1H2017 Key Highlights Slide 5 |

10. My take:

Similar to the REIT IPO of Cromwell and Manulife US REIT, KK US REIT is dominated in a foreign currency, USD in this case. This acts as another layer of risk or reward. Should the USD recover against SGD, the reward from KK REIT might be amplified, and likewise if it were to deteriorate, the gains might be wiped out/loss might be amplified.

The issue price of US$0.88 and P/B ratio of 1.04 suggest that is is fairly priced and trading at a 4% premium. No margin of safety in this case. Gearing of 36% also means that, there is limited headroom available for them to acquire more properties without rights issue.

It's good to know that there is a fairly decent support from the cornerstones investors and sponsors. After reading from the prospectus, if you're someone that is looking for diversification, positive on US growth and comfortable with the metrics mentioned, you might wish to take a closer look at KK REIT.

More information can be found here from Straits Time.

And IPO prospectus for Keppel-KBS US Reit can be found here

Latest Manulife 2Q2017 Financial Results Slides can be found here

Nice article! Looking at point 9, Manulife US REIT seems better. lol. I will be giving this a miss.

ReplyDeleteHi KPO,

DeleteThanks! Haha. Same same but different. LOL

This is a very good analysis indeed. Good comparison wit manulife.

ReplyDeleteHi Unknown,

DeleteThank you for dropping by my blog :)